Non-alliance share begins to fall as freight rates normalise

As the market recovered from the first Covid shock, a confluence of small carriers began to deploy capacity, particularly on the Transpacific trade, and big carriers began to launch services outside of the alliance networks.

The plan was to capitalise on the opportunity presented by the extremely high freight rate environment, according to Sea-Intelligence analysis.

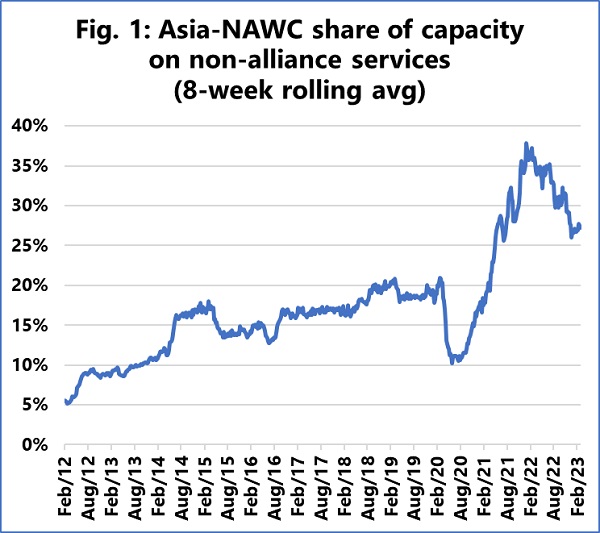

The graph above depicts this evolution along the Asia-North America West Coast trade corridor.

| Read More: Hapag-Lloyd proceeds with new container transshipment hub in Egypt |

"The addition of these non-alliance services meant that at the peak of the market, their market share had essentially doubled," said analysts of Sea-Intelligence.

However, as freight rates began to fall in 2022, the share of non-alliance services began to fall as well, and they are expected to continue to fall in the first quarter of 2023.

"There is still more relative capacity operated by non-alliance services than before the pandemic, but if the rate of decline continues, this will revert back to pre-Covid levels before the end of 2023," commented Alan Murphy, CEO of Sea-Intelligence.

| Read More: Sea-Intelligence reports slight decline in container lines’ schedule reliability |

As the market originally strengthened, there was a similar pattern of adding non-alliance capacity on the Asia-North America East Coast.

Despite the fact that there is a clear reduction heading into 2023, there is no indication that is set to return to pre-pandemic levels. On the Asia-Europe trades, the non-alliance capacity has increased, but not significantly, with no ability to handle material volumes as the figure is around 2%-5%.

However, there is no evidence of non-alliance services losing market share in Asia-Mediterranean in the 2023 first quarter.

Source: Container News

| Read Here | |

|

|