MSC’s orderbook breaks multiple records

With Yangzijiang Shipbuilding recently confirming Mediterranean Shipping Co (MSC) has ordered a dozen LNG dual-fuelled 16,000 teu ships, the orderbook at the world’s largest carrier now stands just shy of 2m teu, a figure so large that analysts are struggling to find the right scale of charts to highlight this extraordinary expansion.

MSC has taken its orderbook to a record of 1.96m teu, equivalent to 43% of its current fleet, according to Linerlytica.

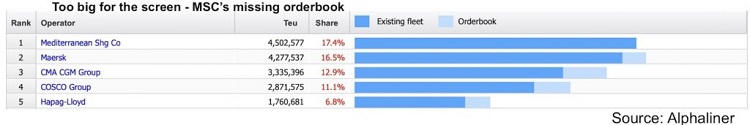

Putting MSC’s giant orderbook in perspective, it is larger than the entire extant fleet of Germany’s largest liner, Hapag-Lloyd, which is the world’s fifth biggest containerline. Adding perspective, MSC’s orderbook is larger than the combined orderbooks of Maersk, CMA CGM and COSCO, the world’s second, third and fourth largest liners, respectively. By Splash estimates, MSC’s orderbook now stands at above 25% of all boxships on order in terms of teu slots. So large and extreme is the Geneva-based carrier’s order tally that it no longer fits in the standard lay-out on Alphaliner’s popular top 100 rankings site.

| Read More: MSC follows Maersk and CMA CGM in launching Air Cargo |

Alphaliner officially recorded MSC surpassing Maersk at the top of the liner rankings at the start of the year. While Maersk has continually stated it does not intend to have a fleet larger than 4.3m teu, MSC has very quickly widened its lead over its Danish alliance partner, the gap today between gold and silver on the Alphaliner podium standing at some 225,000 slots.

With record deliveries coming in 2023 and 2024 for MSC and the global liner industry, speculation is growing that many orders will be deferred. Today’s global orderbook, for which MSC accounts for approximately 27%, stands at around 7.2m teu, significantly higher than the previous 6.6m teu record set in 2008.

The number of secondhand container vessels bought by MSC has also made plenty of headlines in the 26 months since the carrier embarked on an unprecedented ship buying spree in August 2020. In the space of just over two years, the carrier has bought around 240 secondhand ships according to Alphaliner, the latest being the 8,814 teu Northern Jasper, one of three secondhand ships MSC was listed buying last week in multiple broking reports.

“Seeing a large liner company transact does help reinforce some confidence that perhaps we are closer to the S&P market finding its feet, but there remains a significant adjustment on prices still to come if the charter market does not soon find some stability,” brokers Braemar noted on MSC’s latest secondhand buying spree.

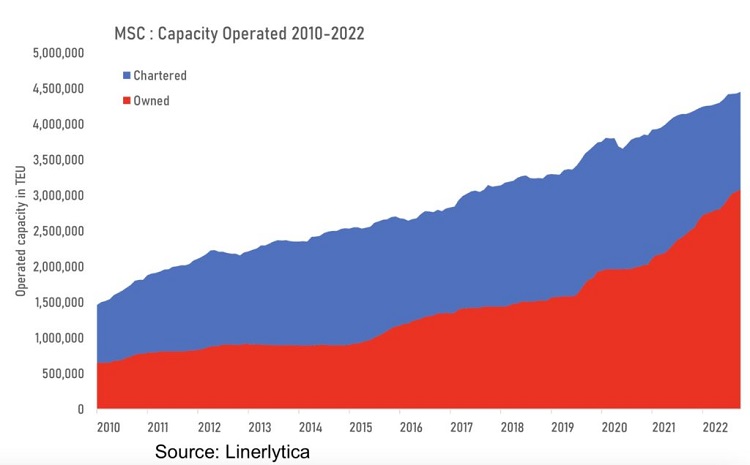

While historically MSC, whose roots date back to 1970, has had a strong focus on chartering in ships, this has changed during liner shipping’s record earnings period of the last couple of years. Since the start of 2020, MSC’s share of owned ships increased to 69% from 51%, according to Linerlytica.

MSC’s actions as the market turns will help dictate market conditions. Not only will other carriers be hoping it defers delivery of many of its newbuilds in the coming couple of years, a massive clear-out of older tonnage for recycling is on the cards for MSC in 2023 and 2024, with many analysts expecting liner scrapping to hit historic high levels soon.

Source: Splash 247

| Read Here | |

|

|