Ukraine war drives port of Constanta rapid container growth

Port of Constanta in Romania, which is located at the crossroads of the trade routes linking markets of the landlocked countries of Eastern Europe with the Caucasus, Middle East and Central Asia, became a cargo-transit hub for all kinds of transport including ro-ro, according to a recent report by Informall BG, a cargo analytical bureau in the Black Sea region

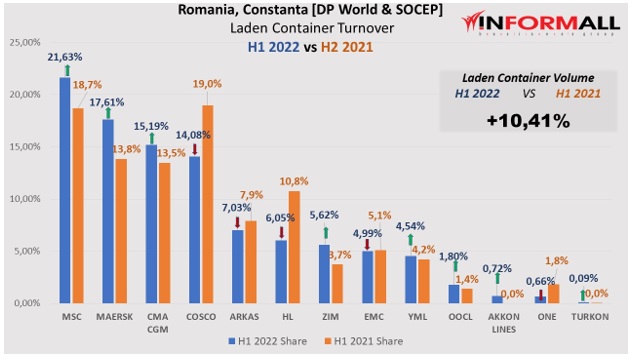

Under normal market conditions, the port of Constanta's annual container turnover growth rate is at 2-3%. However, Informall data shows that Constanta increased its laden container volume by 10,4% in the first half of 2022 vs the same period in 2021.

The reason behind it is the war in Ukraine, according to Informall, which noted that while Ukrainian container terminals remain blocked, a large share of container traffic destined to Ukraine is moving to Constanta followed by transit-truck or train delivery to a final destination in Ukraine.

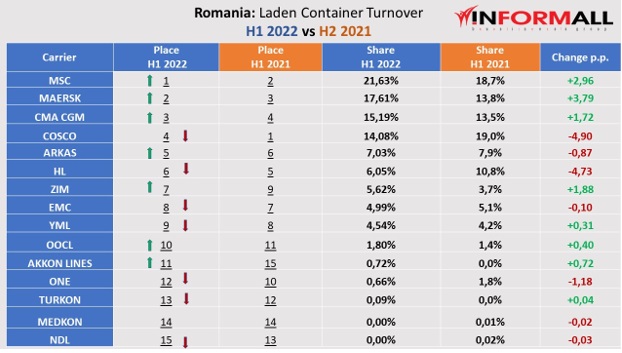

It is important to note that 2M Alliance continues dominating over Romanian container marketplace handling almost 40% of total laden traffic in Constanta. The two partners of the largest container alliance in the world, Maersk and MSC, gained 6,75% of additional container volume in H1 2022 vs H1 2021 in Constanta. Similarly to Romania, 2M Alliance controls 47% of Ukrainian container traffic on the Black Sea.

"Maersk and MSC have been quite proactive in establishing alternative container routes to and from Ukraine after the beginning of the war," pointed out Daniil Melnychenko, data analyst of Informall BG, who went on to explain, "2M Alliance substantial presence on the Ukrainian market as well as a well-established network of domestic transport stakeholders allowed them to develop new container services from the scratch"

Such a rapid increase in transit-container traffic via the port of Constanta has caused a lot of headaches to several terminal operators, such as DP World and SOCEP, according to Informall BG, which said that Constanta container yard utilisation was up to 90% at the end of March 2022 which has been slowly declining throughout the second quarter of the year.

As a result of Constanta terminal congestion, the container dwell time significantly increased for both Ukrainian and non-Ukrainian containers slowing down the overall terminal operation.

Another issue in place is the cross-border congestion between Romania and Ukraine, according to the report.

"Not well-established customs procedures for transit-cargos in Romania are contributing to the slow movement of ocean containers to and from Ukraine via Constanta. Currently, the cross-border time for import trucks moving to Ukraine can reach up to two weeks while Ukrainian export containers are waiting for up to one week before crossing the south borderline with Romania," said Informall BG.

The experts of the cargo analytical bureau expect further growth of box traffic via Constanta during the second half of 2022 mainly owning to continuing transit traffic to/from neighboring Moldova and Ukraine, and increasing ‘Middle Corridor’ cargo traffic towards the European Union.

However, once Ukrainian container terminals are unblocked and back into service, the Ukrainian and Moldavian container traffic will shift back to its favorable and traditional routes via Ukrainian ports, according to the analysts.

Source: Container News

| Read Here | |

|

|